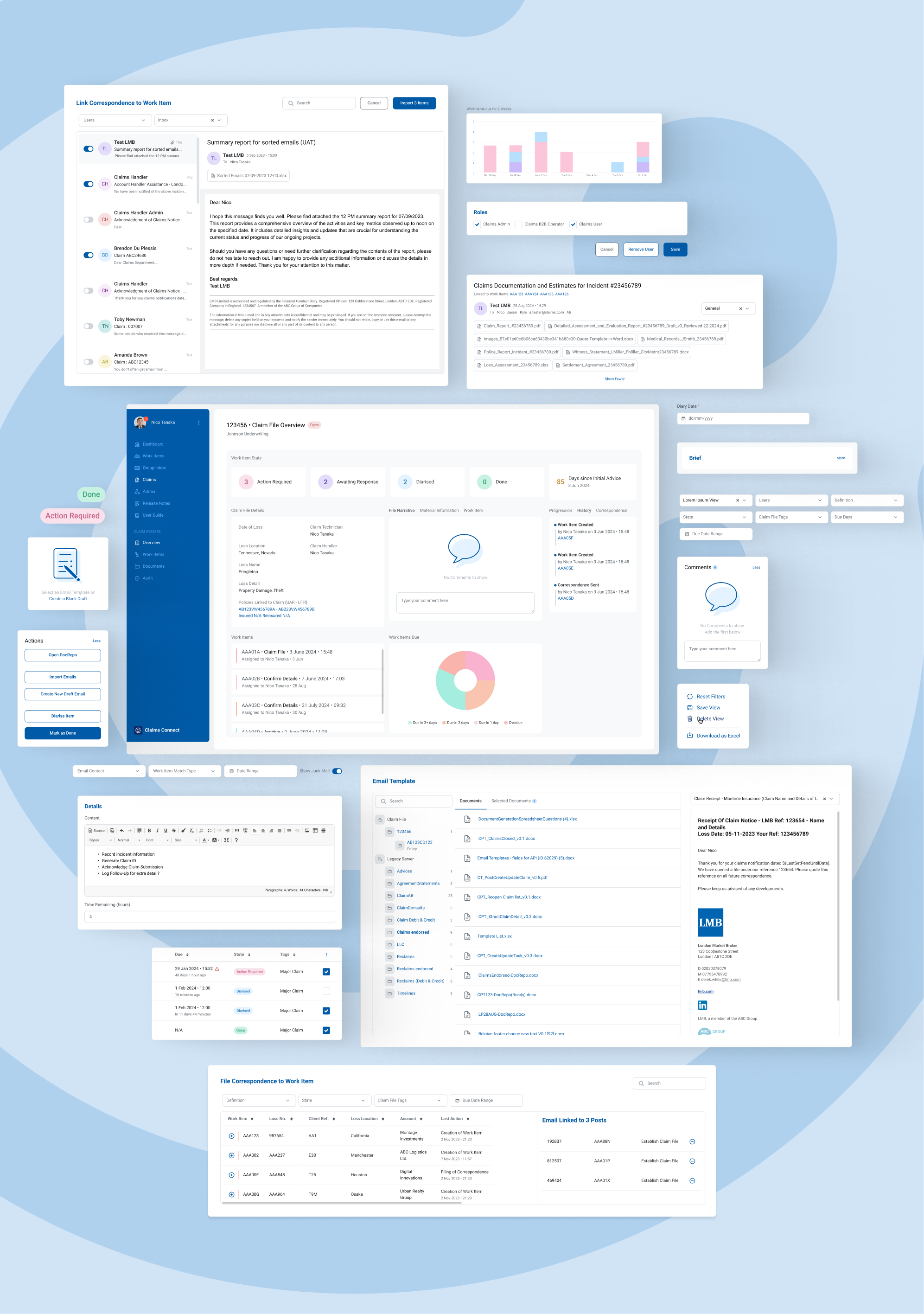

Cconnect is an end-to-end Claims handling application centred around providing clear visibility of every aspect of the claim’s lifecycle from both a claim handler and manager perspective.

Insurance

Web Powered Application

Figma & Figjam

OutSystems & Microsoft 365

Incorporating process critical elements such as active tracking of time sensitive matters, confidential and conflicted claims locking, ECF integration directly from Cconnect, and system generated tracking and diary events, Cconnect functionality provides all the tools necessary for Tysers to proactively progress a claim. Key features include a focus on internal and regulatory risk and compliance adherence, along with on-demand migration of existing claims from legacy systems.

UI/UX Design

- Sketches

- Wireframing

- Base Theme incorporation

- UI/UX Reviews

Project Based

- Azure Dev Ops

- Sprints (SCRUM)

- User Stories

Development

- Architecture

- Full Office 365 Integration: Email and Sharepoint

- Built with OutSystems

Background

Tysers is a leading independent Lloyd’s insurance and reinsurance broker providing specialist solutions and advice to a diverse, international client base. Headquartered in London with offices and associates around the world, Tysers trades in 140 countries across the globe and has over 1,000 experienced and talented employees. It is a member of the AUB Group, an ASX200 listed group of retail & wholesale insurance brokers and underwriting agencies & MGAs operating in ~540 locations globally.

Tysers has a specialised claim handling division which provides claim handling services, as well as an advocacy offering to clients, across a very broad spectrum of classes of insurance and an equally diverse market. Systems iO, Tysers’ software development partner, worked with Tysers on a project to build a new claims handling system.

Cconnect was designed by the joint project team to meet processing requirements across the whole spectrum of claims, from the simple to complex, and affords the flexibility to allow administration configuration to adapt to changes in internal processes.

What the project was like

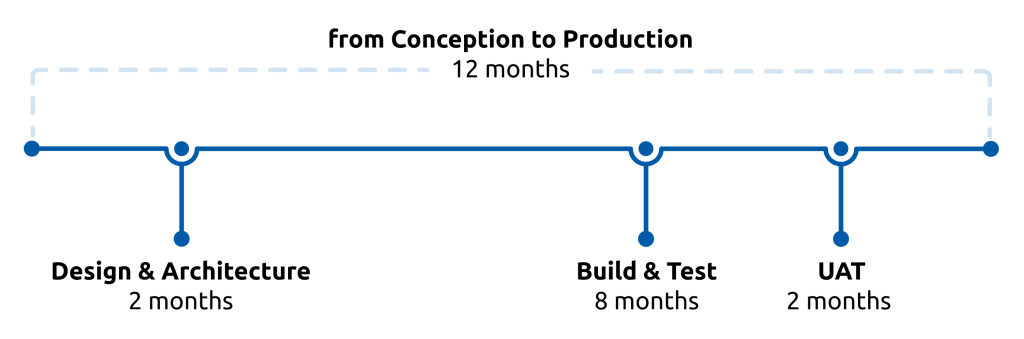

The Systems iO team consisted of three developers, a business analyst, SCRUM master, and a UI/UX designer. They collaborated with Tysers staff including the project manager, claims product owner, and the claims team was very much involved in requirements definition and elaboration as well as user acceptance testing. The methodology was Agile and initially project phases were somewhat blurred due to the early prototyping development commencing before the full backlog of requirements had been approved. Once that process was formalised, the phases were realigned and fell more fully into line with an iterative approach and gaining business approval for the development cycle.

Project implementation → Development → QA Testing → UAT → Sign Off → Training → Deployment → Production

Rollout

Cconnect was rolled out in phases of 10-15 users going live following training until all users had been moved across from the legacy application. Post go-live saw a few anticipated as well as unexpected issues:

Anticipated

- In some cases, irregular or nonstandard risk references caused breaks in the automated transfer of in-flight claims from the legacy platform to Cconnect.

- Further business requirements being presented after Go-Live which had been previously discounted or were entirely new requests.

- Cosmetic changes to the screens, from colour changes to data being presented differently.

Unexpected

- Load issues that affected performance turned out to be erroneous code that was looping through all the work items created to check that the newly created reference was indeed unique. So the more work items there were, the longer it was taking to create a new one.

- There were challenges around emails: problems arose around importing emails which had attachments that were too big. There were also cases where users could not import mails from their “Belgium” accounts, as those had not been configured.

- Configuration issues to the live ACORD ASG Electronic Claim Form processing environment.

Challenges

This project presented a unique challenge: the existing platform, though still functional, had become slow, brittle, and overly complex. The business believed that no new specifications were needed, given that the system still met operational needs. However, without clear requirements, the joint team had to carefully navigate both the technical limitations and the perception that a complete overhaul wasn’t necessary.

It was recognised that any improvements would be mere patches on an already fragile foundation. To address this, the team proposed a complete replacement, starting with a blank slate, and engaged closely with the wider Tysers claims business to flesh out requirements and advanced proposals for approval, ensuring that the final application not only met but often exceeded the needs of the claims division.

The approach balanced technical expertise with an understanding of operational needs, resulting in a solution that resolved performance issues and laid a foundation for future growth, all while maintaining the core functionalities critical to the business. Tysers was able to work with Systems iO development team to resolve the issues they were experiencing with claims processing through the development and successful rollout of Cconnect.

Migrated claims

Work items created

New claims since launch

Build IT Now

Want to learn more about what we can do for your business? And how quickly? Go to the Systems iO services page or

Enjoyed this post? Stay updated with our latest insights, industry news, and exclusive content by following us on LinkedIn! Join our growing community of professionals and be part of the conversation. Follow us on LinkedIn and never miss an update!

If you would like to receive our newsletter direct to your inbox, simply sign up at the bottom of this page.